I’m kicking myself for not implementing this earlier (actually I did implement it a while ago, but didn’t start using it until a few days ago), so I thought I would share some code for once to help out anyone writing and optimizing their own MT4 strategies. I simply call this function after I have taken a position, which saves the current graph (including any information written on it) for later inspection. I have found that this greatly helps me analyse the trade afterwards.

extern int ScreenShotWidth = 1200;

extern int ScreenShotHeigth = 1000;

void TakeScreenShot(int ticket) {

string ScreenShotFileName = StringConcatenate(”Purple_EA_”,Symbol(),”_”,DoubleToStr(ticket,1),”.gif”);

if (WindowScreenShot(ScreenShotFileName,ScreenShotWidth,ScreenShotHeigth)) {

//WriteLog(”Screenshot taken: “+ScreenShotFileName);

}

else {

//WriteLog(”Screenshot failed: “+DoubleToStr(GetLastError(),1));

}

}

Just call the method with the ticketnumber of the trade. This will dump the current graph and all eventual indicators and visible objects to a screenshot.

Finally the day has come. It takes a long time here in Sweden to cash a (American) cheque. About 5 weeks this time (and it costs about $100). But since this morning the money I got back from JadeFX, via NFA, is in the Bank.

Now I must decide how to invest them… I’ll get back to that later. Too much to do at my daytime work right now (it spills over to nights and weekends).

As I’ve started to quickly convert one of my most trusted scalpers to MetaTrader5 (to trade on the Alpari UK ECN MT5 platform) I found this little gem: http://www.mql5.com/en/articles/81

It quickly describes most of the changes needed to get a MQL4 based EA running. When I go through the list I actually can’t understand why some of these have changed. Change without reason is always bad. It does omit trading functions, which is changed quite a bit in MQL5. It is probably a good idea to implement these from the ground up.

By accident I just visited the site of Alpari UK and noticed that their MT5 offering now is enabled for live trading (last time I looked it was only open for demo trading). MetaTrader 5 hasn’t been able to replace the old and trusted version 4 despite being available for quite a long time now.

Alpari UK is apparently hoping this will change if they sweeten the deal a little and is currently offering a MT5 ECN account without commission (!). And you only even have to deposit $200 to test it. The promotion is valid until 2nd of July 2012. Unfortunately I have no EAs to trade the account with, but hopefully I can convert some of my old MQL4 bots without too much trouble.

It is possible to trade micro lots and DOM is available (6 levels). Sounds really good when combined with razor thin spreads without commission (after the promo they will be $6/lot round turn, which is competitive for sure). I’m signing up as I’m writing this

Check it out: http://www.alpari.co.uk/en/trading-accounts/ecn.html (don’t know if you get any rebate by signing via Cashbackforex.com since you don’t pay any commission, but it never hurts either so do it. After the promotion is ended it could be a good idea).

I recently stumbled upon a tool for backtesting and validating EA strategies in MT4 that is quite interesting actually. I have manually been doing the same a few times, but it is a lot of work. The testing strategy is called a Walk Forward Analysis.

Check out the Walk Forward Analyzer. There is a 14 day free trail and cost (only) $30.

I was browsing for eligible brokers when I stumbled across a feature at IBFX AU (which actually seems quite nice. There are some remarks of stop hunting thou…) that I found quite funny. They publish clients positions, in real time. The graph over open positions (of the members) quite clearly shows investor sentiment. Right now everyone seems to think that you should short GBPUSD.

They also seem to have some contest including a quite funny one where you are to guess the coming Non-farm Payroll figure. $1000 to the one who guesses closest to the actual figure.

Check it out at: https://www.ibfxconnect.com/

Wow, it has been a long time since the last positive news in this story now. I’ve actually been traveling through out Africa for for the past 3 months and have tried to not think about it. Just got home this weekend and to no surprise I found no check in the mail. After reading through the forum at Donnas I found out that there should have been some correspondence from the NFA thou, but I have not received any. I’ve sent a email to the appointed contact at NFA and hopefully they will confirm that I’m on the list of account holders and that they won’t miss me when ever they come around to actually giving our money back. Or what is left of it after “administration fees”…

When I finally get my capital I will split it in two accounts. One at Pepperstone and one at FXCC (of course with rebates from Cashbackforex).

Well, first off, I haven’t gotten anything yet, so my hopes are still low. But there are news from Tracey at the CFTC reported through the forum at Donnas (strange that they can’t email us all, they have our contact information). It seems that the Court has finally approved the NFA to start reimbursing the customers. Good news!

But we’re looking at getting 50-60% back according to Tracey, and it isn’t even clear if that is 50% of the account balance on March 1st (when the CFTC shut down JadeFX) or 50% of deposited funds. Additional bad news is that they can’t wire us the money. Instead they will use a time machine, go back to the 1980’s and mail us a check! So silly. American checks are really expensive to cash here in Sweden, and it takes a long time to process. Bad news…

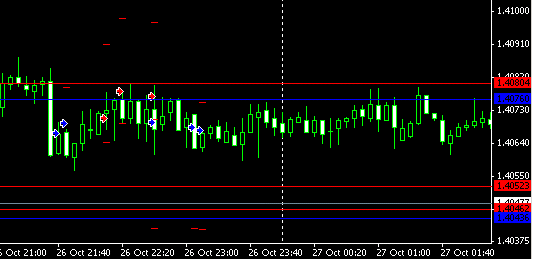

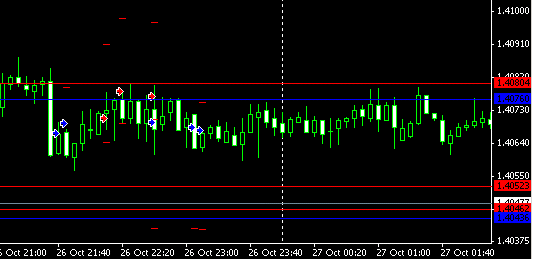

I’ve been noticing this a few times now when scalping GBPCHF around NY close (23:00 GMT). I use very tight stop-losses when price have been trapped in a clear channel for the day (or at least NY session). Sometimes of course this doesn’t work out, price breaks out of its channel. But now and then price have stayed in the channel, but I’ve hit stoploss anyhow on a few account, not all. The one below is a GoMarkets Demo account.

I (or rather my EA) have been scalping the channel both high and low successfully during the timeframe I scalp GBPCHF. I would say that every entry is sound and should be profitable (or close for a break even after a specified time, which is how this EA is programmed). But the first sell (red) order in the picture actually closed at it’s SL level at preciesly 23:00. A level that never was reached if you just check the chart above.

The problem of course is that the broker, GoMarkets in this case, for just a few ticks had a huge spread in this exotic pair. It was probably around 20 pips (but I don’t have the exact ticks saved so I don’t know exactly). This triggered the stoploss and a loss was realized. Just ticks later the spread was normal again and the trade would have taken profit or at least closed out for a break even result.

The solution is to move the stoploss higher, but since I risk a set percent of my total account on each trade I stand to make less profits if I adjust this. Another way would be that the stoploss is moved higher from 22:59 to 23:01, by the EA in question.

I think I will have to try the second solution actually. It would mean that I risk more than I really want for 2 minutes, but on the other hand hopefully filter out these unwanted stop-losses that occur just because there is some turbulence in pricing at NY close.

I’ve written a bit about this before. But now the live Pepperstone account have traded for a while, and I would classify the second half of September as quite hard because of the turbulence in the markets. Seems as Forex Shocker v3.0 is quite picky when to trade, which is good if it picks the wright times of course. And, well, it has. Do remember that they had losses in early August, but that they restarted the MyFXBook account to hide them. A silly move of course because no one cares about losses if they are balanced with more profits. A system that never loses doesn’t exist.

http://www.myfxbook.com/members/shockerv3/shockerv3/148370