Spread triggered stoploss in GBPCHF

I’ve been noticing this a few times now when scalping GBPCHF around NY close (23:00 GMT). I use very tight stop-losses when price have been trapped in a clear channel for the day (or at least NY session). Sometimes of course this doesn’t work out, price breaks out of its channel. But now and then price have stayed in the channel, but I’ve hit stoploss anyhow on a few account, not all. The one below is a GoMarkets Demo account.

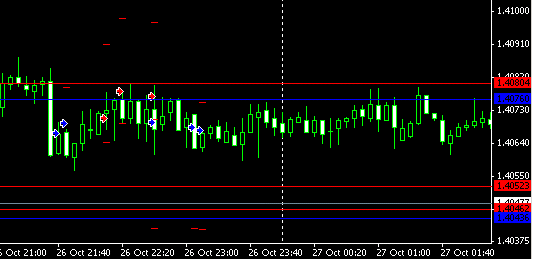

I (or rather my EA) have been scalping the channel both high and low successfully during the timeframe I scalp GBPCHF. I would say that every entry is sound and should be profitable (or close for a break even after a specified time, which is how this EA is programmed). But the first sell (red) order in the picture actually closed at it’s SL level at preciesly 23:00. A level that never was reached if you just check the chart above.

The problem of course is that the broker, GoMarkets in this case, for just a few ticks had a huge spread in this exotic pair. It was probably around 20 pips (but I don’t have the exact ticks saved so I don’t know exactly). This triggered the stoploss and a loss was realized. Just ticks later the spread was normal again and the trade would have taken profit or at least closed out for a break even result.

The solution is to move the stoploss higher, but since I risk a set percent of my total account on each trade I stand to make less profits if I adjust this. Another way would be that the stoploss is moved higher from 22:59 to 23:01, by the EA in question.

I think I will have to try the second solution actually. It would mean that I risk more than I really want for 2 minutes, but on the other hand hopefully filter out these unwanted stop-losses that occur just because there is some turbulence in pricing at NY close.